Financial Planning is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise.

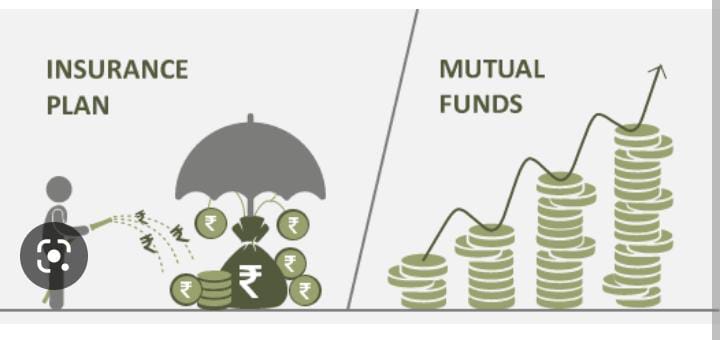

1. Life Insurance vs Mutual Fund

Life Insurance secures our family’s future financial stability in our absence. Mutual Funds are an investment tool that enhances our wealth through market-linked investments, we are not sure about the future investment scenario. As per my knowledge first, secure our family then take the risk.

An insurance policy assures that your nominees are thoroughly secured in the event of unexpected situations in your life. Once you buy a life insurance policy, the insurance companies are bound to pay the full sum assured if you pass away during the term.

Life Insurance

Mutual Funds

A protection scheme that secures the future financial stability of our family in our absence.

A requisite part of our financial portfolio that safeguards the financial future of our dependent.

Involve low risk as compared to mutual funds and it offers a guaranteed death benefit.

Low return because of zero guarantees of returns.

An investment tool that enhances our wealth through market-linked investments.

A rewarding investment that helps our long-term financial goals.

Involves high risk as it does not guarantee returns and comes with no death benefits.

High returns due to diversification of funds.

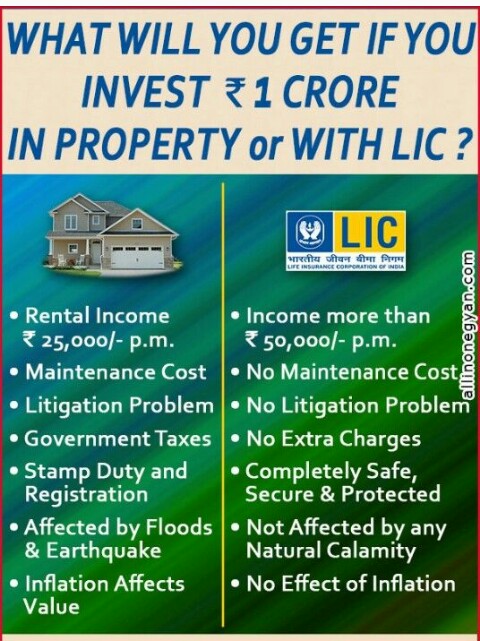

2. Life Insurance and Real Estate

The relationship between Life Insurance and Real Estate investment can be best described as the Thai Expression “same same, but different”.

The key difference here is, that while you have to wait until the last EMI is paid on a home loan or to a builder to receive the formal possession of the asset in our name, for life insurance, the sum assured amount belongs to you from the very moment the first premium is paid and you are the owner the asset which is guaranteed to be paid to you or your nominee on the occurrence of the insured event’s-maturity or untimely death.

Second, a life insurance policy is a tax-free financial asset, whereas real estate investment is not as liquid and the gains are taxable. When investing in real estate, we are compelled to exercise due caution, and appropriate legal advice and run myriad checks to safeguard our interest

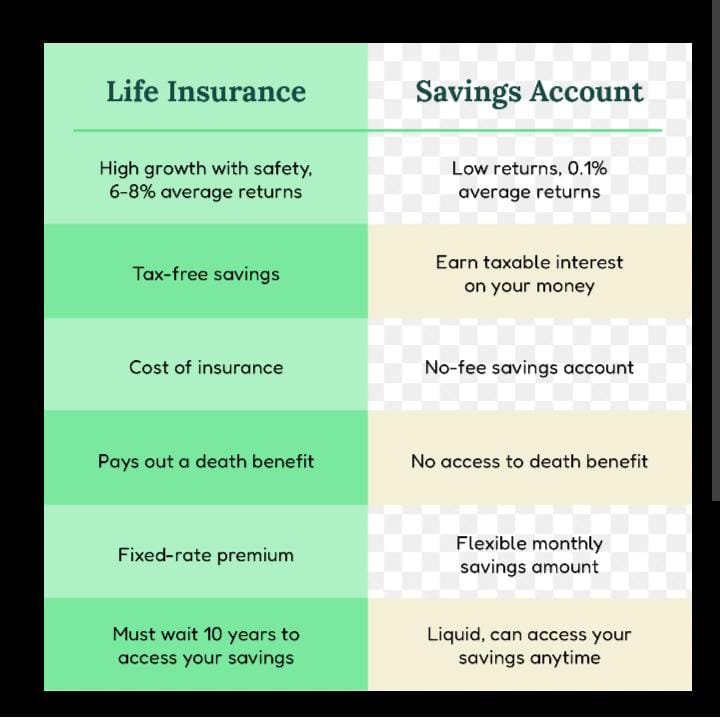

3. Is Saving Better Than Life Insurance

First of all, life insurance is not just for people who are going to die soon. Life Insurance can be a very important safety net for our family during our death. For example, if we have young children, life insurance can help ensure that they are taken care of financially if something happens to us.

Secondly, life insurance can be quite affordable. Of course, Life Insurance costs depend on several factors, including age, and health. However, if you’re healthy and young, you may be surprised at how affordable life insurance can be. On the other hand, whole life insurance has a cash value component that grows at a guaranteed rate. This means that your money will always keep up with inflation, no matter the interest rate.

So, what is the better option? It depends on your circumstances. However, Life Insurance may be the better choice if you are looking for financial protection for your family.

Take some time to compare saving money vs. buying life insurance and make the best decision for you and your family. You may be surprised at how affordable life insurance can be and how much peace of mind it can provide.

If you are not sure where to start, our team of experts can help. Contact us today, and we ‘ll be happy to answer any of your questions.