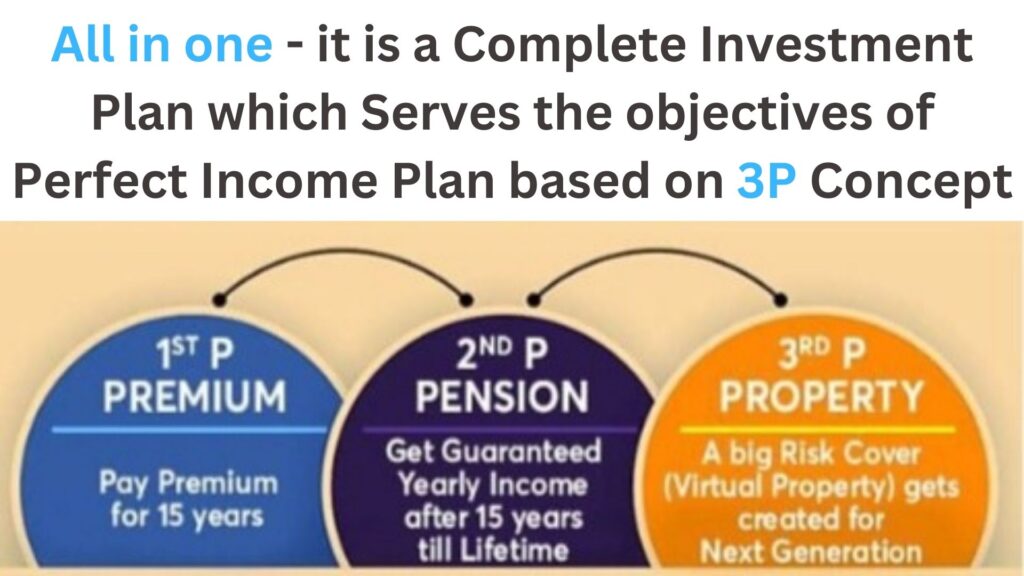

3 P, Premium, Pension, Property.

आल इन one is one प्रोडक्ट to गेट everything इन one प्लेस। This plan from LIC of India एंड is one of the best options to have. Everyone wants to grow in their life सो we are saving or investing blandly to get more return but sometimes we lose our capitals.

Some study from 6 years to 25 years. Then he started a career to earn money by way of service or business. And get retired at the age of 60 as per the government (People work till the end of their life), such a long period can’t save money. All in One is such a plan to fulfill everyone’s dreams. If they plan and take action on this plan, it is good because they have to save a short period to commit.

Table of Contents

Toggleइन्वेस्टमेंट ऑफ़ Capital

All in One such a product to Invest, your कैपिटल इस guaranteed, इंटरेस्ट on Capital also guaranteed एंड company also guaranteed. What you नीड more. Here गेट peace of mind, Tax Free Income, Legacy for our next generation. Create a symbol for society. Even your next generation follows your path.

Return of Capital and Interest

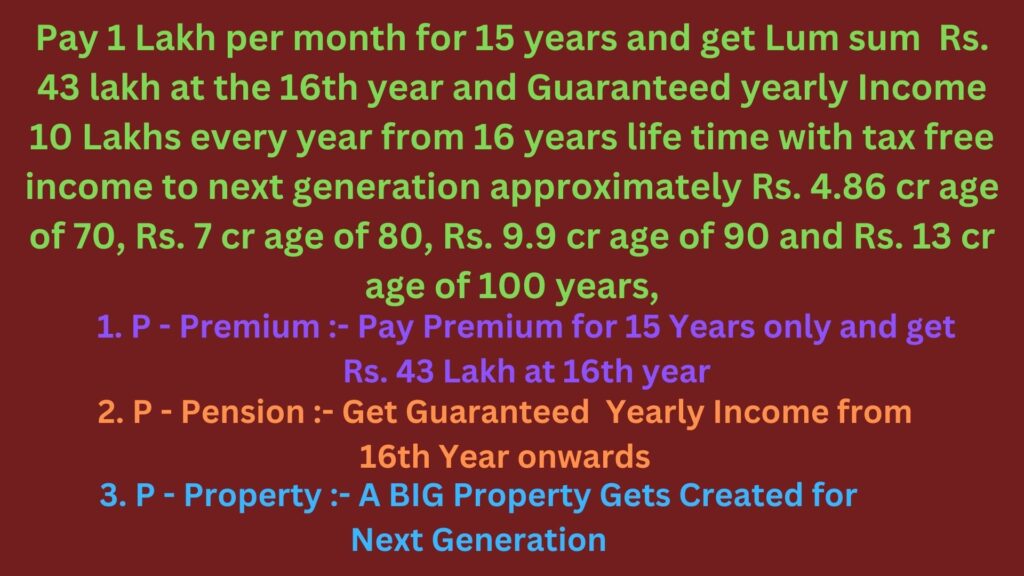

इन्वेस्ट on All in One, for example one lakh per month for 15 years only, at the 16th to get Rs. 43 lakh and 10 lakh income (Pension), every year फॉर lifetime. Also get created a BIG corpus like property for the next generation.

Family or Business Plan

Other benefits like encash any time during the income period like age of 70 get Rs. 4.86 Cr, age of 80 get 7 cr, age of 90 get 9.9 cr or age of 100 get 13 cr. Risk cover also continues till 100 years. Either way, you are a Money Making Machine (MMM), for your family or business. So it is better to have an All in One plan for everyone.

3 P, Premium, Pension, Property.

Paying the premium is a short period so do not worry about making a long term commitment. After paying the premium to get at the age of 16 and thereafter getting income like pension life time. Same time we leave a Big Legacy for our family members, like Property. This word says capital creates interest but here your interest creates capital, Which formula do you want to follow? It depends on your goals or vision.