Dhanversha

A Lic is the best plan Every person has a dream of having a property so they do not mind paying EMI for this decision. Say one property cost is 30 Lakh in a small-medium city after spending a down payment taking a housing loan say 25 lakh approximately EMI to become around 22000 per month for 15 years. They have seen all the environment like taxation, location, inflation, on-time EMI, survival of person and financier and many things involved. But nobody can predict what future situation.

Considering all aspects we see what LIC do in the same way – pay Rs. 22,000/- per month for 15 years and get the benefits given follow –

16th year get Rs. 16,00,000/-

21st year get Rs. 21,00,000/-

25th year get Rs. 25,00,000/-

35th year get Rs. 1,00,00,000/-

From the 16th year onwards getting periodical money to help with your day-to-day expenses as it is from LIC you will enjoy 100% peace of mind. From day one you are enjoying Life Cover, tax benefits, no tds on return, natural & accidental cover, CIR and disability also cover. This is a good thing for emergency funds available after 2 years but as your property is assigned no funds available when you need them most.

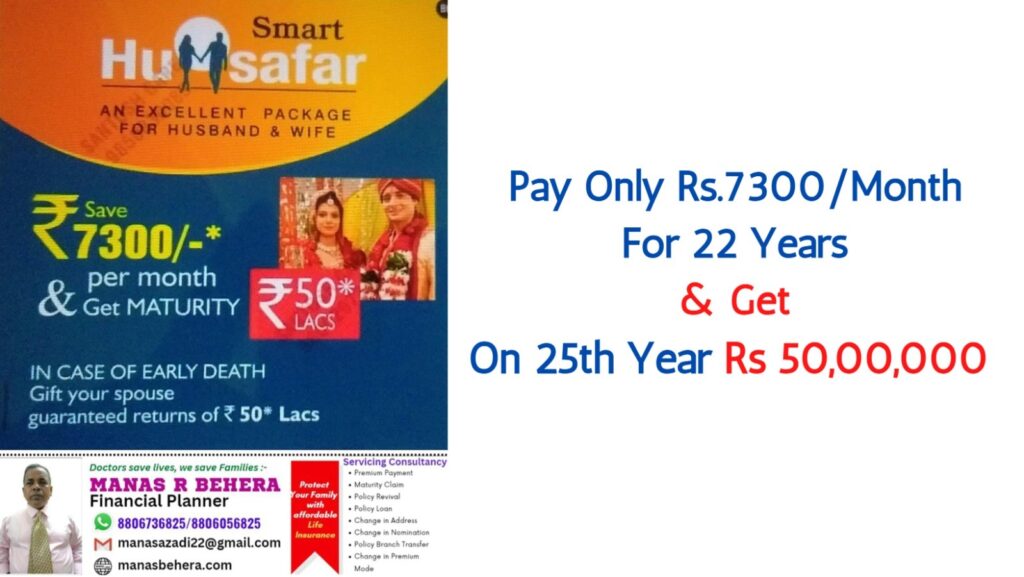

Hum Safar

Hum Safar is the best plan for newly married husband and wife for their future. Get 50 lakh at the time of the 25th year and pay 22 years, next 3 years holidays given from LIC. During this time they can enjoy life cover along with other benefits. For this plan they have to pay only 7300 per month, it is the best plan from LIC, and no company has one like this. Out of this as an insurance plan, other benefits are available like tax holidays, no TDS at the time of return, natural & accidental cover also available, CIR and loan facility also available.

All In One

As a parent, it is our responsibility to our daughter with education, higher education and marriage. To fulfil all these needs in general and our children’s needs in particular, LIC has the best plan to give you a unique plan, it is called ALL-In-One, a combo plan. On this unique plan, you will get 25 lahks at the child age of 16th for junior level education, next for higher education age of 19th you will get 25 lakh and final stage about the marriage at the age of 25th you will get 40 lahks, so tell me it is not fantastic plan for daughter education, higher education and maggiage. For details please our website.

Education

Nowadays education has become very expensive for our children, as parents they are very conscious about it and our children. LIC has the best education plan and does not worry about it let the LIC fulfil your dream of education.

It provides you with your education fund periodically from the age of 16 to higher education at the age of 24. Such as the age of 16th get Rs. 4.50,000/-. Age of 18th gets Rs. 4,50,000/- and from 20th to 24th every year get Rs. 3,00,000 to manage your child’s education expenses. So fulfil your child’s education go for this and enjoy peace of mind. There is no market risk. God forbid if you are no longer in this world your children’s education not effect.

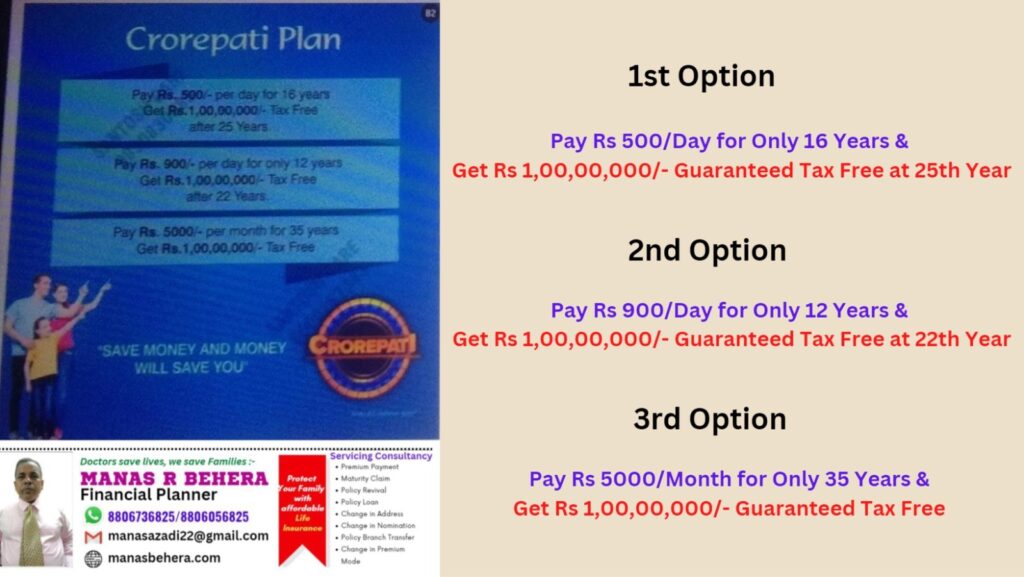

Crore Pati’s Best Plan

Option 1 – Lic bringing out a world-class plan like the Crore Pati is the best Plan. This is a combination plan for general people. People want to get more returns but do not want to take more risk for paying liability so they want to pay short term, say 16 years and get holidays next 9 years, but during these 9 years

Get a higher bonus and enjoy life cover. For example, pay 16 years Rs. 500/- per day and get at the 25th year Rs.1,00,00,000/- tax-free return from LIC having other benefits like risk cover (natural & accidental) CIR, tax-free, tax rebate, loan facilities and many more.

Option 2 – Nowadays people do not want to take the burden of paying long-term premiums so they want the short-term but never mind taking a little bit of pain to pay more premiums, same time they want to get fruit at an early age.

Looking at this matter LIC bringing out a wonderful product paying only 12 years and getting the maturity at the age of 22 years Rs.1,00,00,000/- For this purpose you have contributed

Rs. 900/- per day for 12 years only and the next 10 years holiday, enjoy other benefits like CIR,

tax-free, tax rebate, loan facilities and many more.

Option 3 – Some people want to pay from an early age and want to pay less and get more maturity at the time of retirement like PF. Because they want to start early age get risk cover throughout life with less premium. I think it is a good decision for the young generation. For this purpose, you have to save Rs. 5000/- per month and get guaranteed Rs. 1,00,00,000/- from LIC at the age of 35 years and enjoy other benefits like CIR, natural/accidental death, disability due to accident, tax-free, tax rebate, loan facilities and many more.

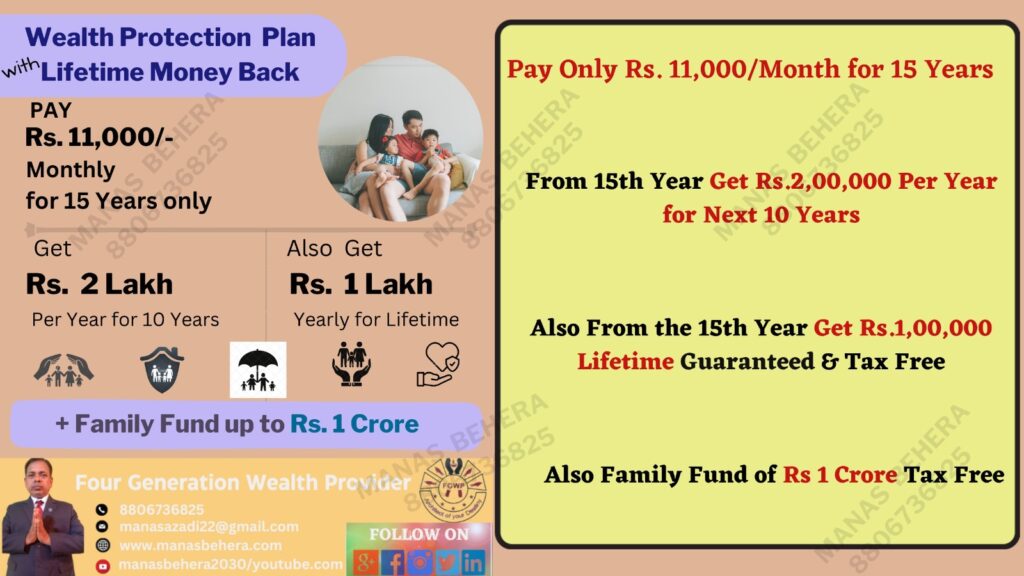

Wealth Protection

LIC has different products/ best plans as per your requirements. Like that wealth protection is one of them. Having premium paying liability is short term and getting tax-free income lifetime. For your understanding give a blueprint here so you can plan as per your income or savings.

Say your age is 30, the Premium paying term is 15 and pay 11,000 per month. After the 15th year, you will get 2,00,000 per year for the next 10 years and thereafter get 1,00,000 per year lifetime tax-free. After your death, your next generation will get Rs.1,00,00,000/- tax-free income. During this term whenever you want funds you can encash it. It is best to plan saving-minded people who are thinking about their future protection. It is said, “Something is better than nothing”.

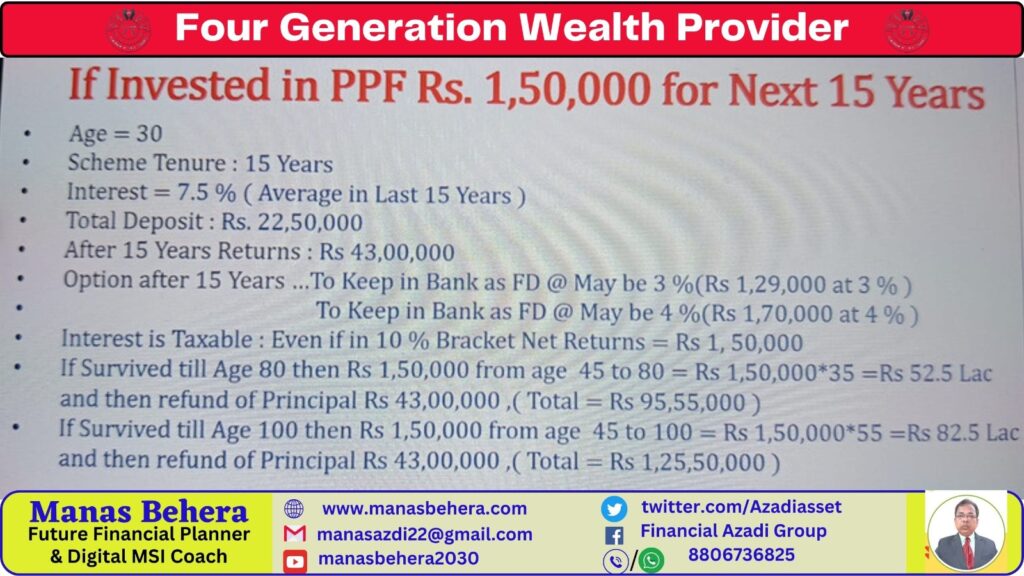

LIC v/s PPF

PPF is a good investment instrument and managed by Govt of India.

It is very popular among the govt employees, public sector firms and limited companies. The rate of interest coming down day by day in 1999 it was 12% but in the year 2020, it was 7.6% so imagine what will happen from now onwards about the PPF interest rate. Let’s compare between PPF and LIC PPF Concept:-

PPF LIC Best Plan PPF Concept

Rs. 1.50.000/- *15 = Rs. 22.50.000/- Rs. 1.50.000/- *15 = Rs. 22.50.000/-

After 15 years=Yearly=Rs.1.50.000-Taxable After 15 years=Yearly=Rs.1.50.000-Taxfree

Payout Up to Age 80 = Rs.52.5 Lakh Payout Up to Age 80 = Rs.52.5 Lakh

Total Benefit Up to Age 80 = Rs. 95.55 Lakh Total Benefit Up to Age 80 = Rs. 1.64 Crore

Total Benefit Up to Age 100 = Rs. 1.25 Crore Total Benefit Up to Age 100 = Rs. 2.18 Crore

No Sum Assured Benefit Sum Assured Benefit 19,00,000

No Risk /Life Cover Benefit Risk /Life Cover Benefit Yes

No Disability Benefit Disability Benefit – Yes

No CIR Benefit CIR Benefit – yes & many more

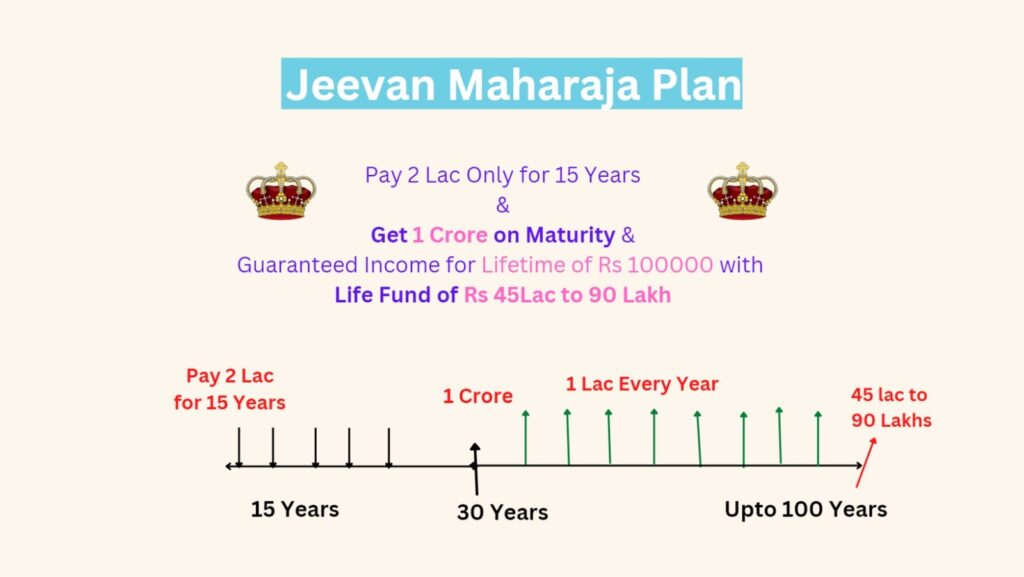

Jeevan Maharaja

Someone said – Live Life King Size, It is possible from LIC only.

We are earning and spending our life in old age with nothing with us to survive because we did not plan properly for the future. To blame here and there but the result is a Big “ZERO”. So LIC has a better plan called Jeevan Maharaja, which is a combo plan. People do not plan for a longer period premium paying term instead they choose a short period. So as per budget, you can decide how much can you save it is your choice.

For your convenience, we are giving the option for 15 years only. we make a blueprint for your understanding in practice. Say your age is 30. Paying a yearly premium of 2 lakh for 15 years means now your age is 45. The next 15 years are holidays means no need to pay the premium. Now you are at the age of 60. So here you will get Rs. 1,00,00,000/- tax-free income and no tds on it. From 61 one onwards getting Rs. 1,00,000/- every year tax-free income. From 30 to 60, you are enjoying your life cover/risk cover.

After 60 whenever leave this world your family get again 50 lakh to 90 lakh depending on which age you want to live. The most important USP of this plan is the fund that way your family get it. Say you have some property in your name, all your family members staying together, whatever reason may come but can’t sell it. Emotionally we are all attached to this property. But in LIC whenever you want to sell it (Surrender or Loan) or mortgage and take cash value. That means in very old age it will help you and your family financially. The best example is Raymond’s exowner Mr Vijaypat Shingania do not want to explain any more about it. Once again “Live Life King Size”.